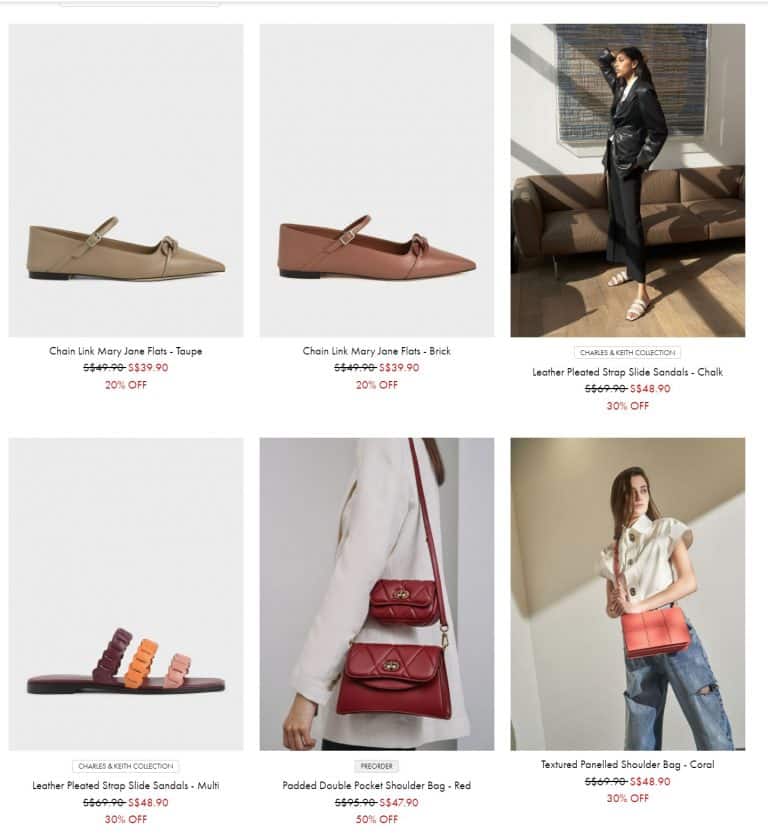

As college campuses and universities gear up for another exciting academic year, many students are seeking not only knowledge but also ways to save. Notably, Charles & Keith, the stylish footwear and accessories brand, has stepped up by offering a 15% student discount. This initiative is not only a financial relief but has opened discussions surrounding the mental health challenges students face today. Are such discounts a façade to entice emotional spending? And how do students feel about them? To explore these questions, we spoke with experts and students alike.

charles and keith student discount

Dr. Emily Chen, a psychologist specializing in youth mental health, stated, “Discounts can generate a feeling of happiness among students, granting them access to luxury items they might otherwise forgo due to financial constraints. However, it’s essential to ask if these discounts are deepening underlying issues such as anxiety or depression.” This insight connects to a broader narrative. College mental health statistics reveal that approximately 1 in 3 students experience significant emotional distress, yet only a fraction seek help.

charles and keith student discount

“While I appreciate the discount, I can’t help but feel pressured to rationalize my purchases,” shared 20-year-old Sarah Johnson from New York University. “Sometimes I find myself buying things I don’t need because they’re on sale. It’s a cycle,” she added.

charles and keith student discount

Moreover, a recent survey conducted by Student Beans indicated that 72% of students are more likely to purchase from brands that recognize their budget constraints with discounts, raising the question: do these promotions exploit a mental health crisis among students? “These discounts serve as a psychological trigger,” Dr. Chen elaborates. “They amplify the ‘spend to feel good’ mentality, contributing to what we classify as retail therapy—an emotional band-aid that, in the long run, might exacerbate financial anxiety.”

For students like Michael Evans, a junior at UCLA, these discounts feel like a double-edged sword. “I love the idea of saving money, but sometimes it feels like I’m in a race to use the discount before it expires. I often end up buying unnecessary items just to take advantage of the deal,” he explained. “It’s a slippery slope.”

However, positive responses can also be found. Many students articulate that receiving discounts is a vital affirmation of their struggles. “Being able to buy that cute pair of shoes or bag at a lower price makes me feel valued. It reminds me that brands like Charles & Keith see us and our needs,” notes Rebecca Smith, a senior studying fashion at Parsons School of Design.

“With the ongoing financial pressures due to tuition hikes and living expenses, such discounts help in easing the burden, even if just slightly,” said Adam Barnes, another student who active on social media forums discussing fashion and student discounts.

From an economic standpoint, the student discount program introduced by Charles & Keith aligns with current consumer behavior trends. According to data from Statista, the global student discount market is projected to reach over $400 billion by 2025. “Brands like Charles & Keith are smart; they’re tapping into a largely underserved market,” noted fashion economist Dr. Fiona Lee. “However, this poses ethical questions: are they catering to a genuine need, or profiting off student insecurities?”

Given these multifaceted perspectives, the balance between bestowing financial relief and creating possible emotional consequences remains delicate. As students navigate price tags and mental health, brands are encouraged to advocate for positive spending mindsets while simultaneously promoting financial literacy. This is echoed in the response to Charles & Keith’s student discount: “It’s great, but we need education on budgeting just as much,” shared Naomi Patel, a financial education advocate.

“The emphasis should not only be on discounts but on creating sustainable financial habits among students,” remarked Dr. Chen.

In reflection, it’s clear that programs like the Charles & Keith student discount offer essential financial respite but also magnify the need for broader discussions on mental well-being. Shopping shouldn’t become an emotional crutch; rather it should symbolize empowerment. Ultimately, as students embrace fashionable choices, the conversation shifts to how brands prioritize support without straddling the fine line between relief and exploitation.

As the new academic year begins, students are encouraged to apply for Charles & Keith’s discounts through platforms like UNiDAYS and Student Beans, but not at the expense of their financial well-being. Is shopping a privilege, promotion, or a potential pitfall? The answer might just lie in how we collectively view and approach consumerism.

For those interested in keeping up with wellness strategies for students, [tap into community support](https://t.me/edumail88). As discussions around mental health continue, understanding how to navigate the intricacies of financial pressures becomes ever more crucial.